(2 min read)

You can create and file disclosure reports from the Disclosure Center. If this option does not appear for you but you would like to add this, please talk to your Account Executive.

Reviewing your data using compliance and disclosure reports

If you are in charge of filling disclosure or compliance reports for your organization, you can use our specialized reports available in Report Manager to help you review your data before submission. What you see here will depend partly on your state or filing district and partly on your package and user permissions.

Some of our useful Default reports include:

- Contribution Over Limit Report - displays all contacts with contributions that are over the limits

- Disbursement Over Limit Report - displays all contacts with disbursements over the limits

- Disclosure Error Report - displays a list of major and minor errors for a selected disclosure report

- FEC Schedule Report - shows a list of contacts and transactions in a generated FEC Report

- [State] General Purpose Report - this report verifies your common state disclosure fields are accurate

- Missing Employer or Occupation Report - displays contacts who have made a contribution but are missing Employer or Occupation

We also have several Data Integrity PDF reports you can use:

- [State] Contribution Limit Report - displays contribution totals for all periods within a cycle

- Credit Card Report - compares credit card payment disbursement amounts to itemized totals of linked disbursement

- Debts Owed to the Committee/ Debts Owed by the Committee - these two reports help you track your debts and repayments

- Fundraising Breakdown Report - displays types of contributions and contributors in your total

- Independent Expenditure Report - displays total independent expenditure per race

- Joint Fundraising Report - compares joint fundraising amounts to the itemized totals for linked contributions

- Loans Made/Loans Received reports - these two reports help you track loans made and repayments

- Partnership Report - compare partnership/LLC member contributions to the itemized totals of the linked contributions

- Reimbursement report - compare total reimbursement payment amounts to itemized totals

You can also run more disbursement reports to help track expenditures.

Read more about disbursement reports

Filing your report

Once you are ready, you can file your report by opening the Disclosure Center from the Sidebar or from Main Menu > Disclosure > Disclosure Center.

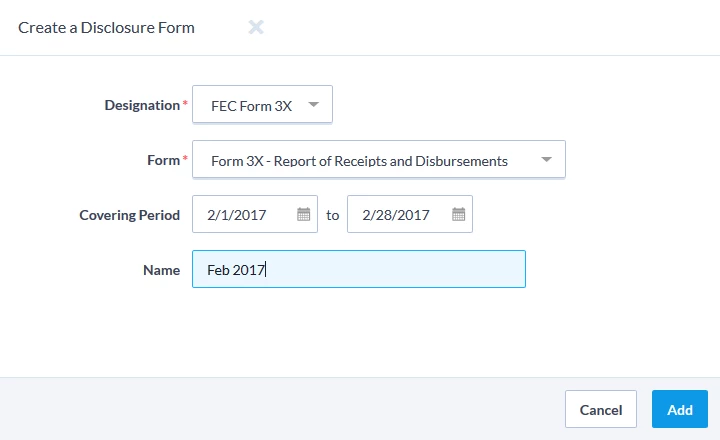

Select Create New Disclosure Form and then enter the Designation, Form Type, Covering Period, and an internal name for this particular Disclosure Report (this is optional). The Covering Period of any report must be contiguous with the previous report of the same type.

When you select Add, the form is created and you can then enter the information listed in your documentation below for your particular report. Be sure to double-check your entries with your filing agency to make sure you have included the correct information.

>> Federal Report Documentation

>> State Report Documentation

When you have received confirmation from the FEC or your State Board of Elections that they have received your form via the Transmission Response Message section, you can then mark it as filed in your database by clicking mark as filed at the bottom of the screen. It will need to be marked as filed in order to amend it in your database.