Our tools are designed to help you track fundraising contributions and easily import data into your external accounting software.

Run this process on a daily, weekly, or monthly schedule. You will have fewer errors and will avoid doubling your data entry.

Setting up your workflow

When entering or adjusting Contributions, Recurring Commitments, or Pledges, you should follow a documented process that has internal controls and results in consistent records.

Read more about financial management practices from the National Council of Nonprofits

Have a process for:

- recording every contribution, recurring commitment, or pledge with the proper source code

- updating payment settlement status if you’re not using an integrated payment processor. Worldpay contributions, for example, need to be updated manually.

- recording refunds or adjustments

If you are entering pledges, use the Pledge Status fields to identify which pledges are bookable in your General Ledger. If you have a development package that includes the General Ledger Pledges report, you will see pledges when they are marked To Give, Unconditional, and Promise.

Using source codes for easy tracking

Before you begin entering contributions, you will need to set up a tracking system to ensure you have everything you need to import transactions into your accounting system.

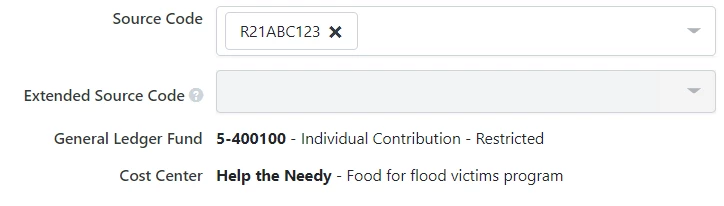

Creating source codes that can be matched to your accounting records and used for searching and reporting will make it easier to track contributions and reduce extra data entry by automatically associating transactions with particular campaigns, channels, and other details.

If you have one of our development packages, you will also be able to create General Ledger Funds and Cost Centers that match the Chart of Accounts in your accounting software. When added to source codes, they are automatically associated with transactions recorded with those source codes, and can be easily matched to your accounting software.

Read more on General Ledger Funds and Cost Centers

Once you’ve created your source codes, you will want to apply them to all contributions submitted through your donation forms by configuring them on all your Online Actions forms and using query strings on all links to donation forms from Targeted Email and elsewhere.

Read more about using query strings

As a best practice, make the source code a required field on all Contributions. This should already be enabled in your database. If not, talk with Support about turning it on for your organization.

Read more on adding contributions

You can speed up your manual gift processing and maintain quality control of your transactions by using the Financial Batch Manager to help you create and manage your daily batches of transactions.

Add the source code field to your Quick Entry Configuration so that all your contributions have the necessary tracking details applied.

Read more on Financial Batch Gift Entry

Contributions processed through a Recurring Commitment automatically receive the source code assigned to the recurring commitment. If you change the source code, it will be applied to all future transactions, but will not impact any historic gifts that have been processed by that commitment.

Read more on managing Recurring Commitments

Making adjustments

You can change and edit individual contributions or pledges before they are posted to your accounting system. Follow a trackable process to issue refunds, account for chargebacks, and record adjustments to transactions.

If you need to make changes to groups of records, you can Bulk Edit entries of the same value. This can be useful for applying the same source code to a group of records or updating the Settlement Status for payments whose settlement information is not automatically synced back to your records, such as transactions processed by Worldpay.

Read more on bulk editing contributions

Read more about tracking settlement status on contributions

Once the transaction has been marked as Posted or is part of a Closed financial batch, some fields will no longer be editable and you will need to make a Data Adjustment or refund the original contribution. This is to ensure changes are reflected properly in your accounting system.

Read more on adjusting contributions in EveryAction

Read more refunding contributions in NGP

In some cases, you may need to write off a pledge. This usually happens when you’ve been informed that the pledge will not be fulfilled but it already exists on your books. Be sure to follow the proper procedure to write off these promises in your General Ledger Fund.

Read more on Pledge write-offs

Reviewing your transactions

You will probably want to establish a set schedule for how frequently you will reconcile your data to your accounting system. It can help to document a clear process to follow each time for reviewing data and checking for errors.

Consider the following in advance:

- The date range of gifts. You may transactions to settle before you post them.

- Which settlement statuses to include

- Which payment methods to include

- Which pledges are bookable

- Will contributions that were fully refunded before being posted be included in your accounting?

Talk through the types of contributions you receive and develop a process that works for both your fundraising team and accounting team.

Using the Reconciliation Report

Before you reconcile your accounts or mark any transactions as Posted, do a thorough review to ensure all transactions have a source code and that you have all the information you need in your accounting system.

To quickly review your transactions and assess whether they are ready to be posted to your accounting system, use the Reconciliation Report. This report displays all contributions (including refunds and adjustments), information about their statuses, settlement batches, and dates from your online payment integrations.

You can group the report by Date Sent to Bank or Batch Sent to Bank and then match it to your bank statements to verify that it accurately represents all transactions received.

Read more about using the Reconciliation Report

Exporting transactions to your accounting system

If you have a development package and you plan to export your data into your accounting system, use the General Ledger Reports to review your transactions and ensure they are ready to post. Then customize the output to include the data you need exported to your accounting software.

These reports include:

- General Ledger Contributions Report

- General Ledger Pledges Report

- General Ledger Adjustments Report

Contributions are reported separately from adjustments. The Pledges Report includes both Promised Pledges as well as any write-offs.

Read more about using General Ledger reports

You should set up each of these reports to include the fields you want to import to your accounting system. Be sure to save your final configuration for future reporting.

When you are ready, use Export and Bulk Apply to both export the transactions you selected from the report and mark them as Posted. Posted transactions cannot be undone. To correct a mistake or make a change in the data, you will need to make a Data Adjustment.

The QuickBooks Contributions Report is another option for exporting transactions to your accounting system. You can use the report to export contributions from our system to your QuickBooks Online account for contributions already received.

Read more about managing QuickBooks accounts and reports

Importing data into your accounting system

In some cases, you will be able to immediately import the file to your accounting software. In other cases, you may need to take an additional step to adjust the data to the needs of your accounting software.

Here are a few third-party packages that prepare your data for import to your accounting software:

Looking for training?

Explore this feature at your own pace - join a live training session or watch a recorded webinar by clicking the link below.