Non-cash contributions such as stock, grants, tribute gifts, and planned gifts often require special entry methods. Use the appropriate workflows to ensure your reporting and donor records are accurate.

Step 1: Start a new contribution entry

- Go to Contributions > Add Contribution.

- This is the starting point for entering both stock and special contributions.

Step 2: Choose how to handle the contribution

Depending on the type of contribution you're entering, follow one of the two paths below:

If you're entering a stock contribution:

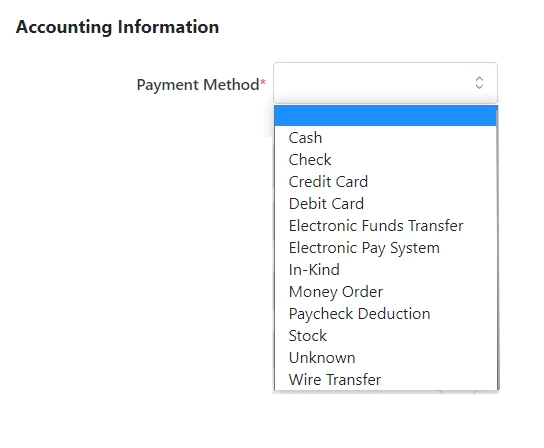

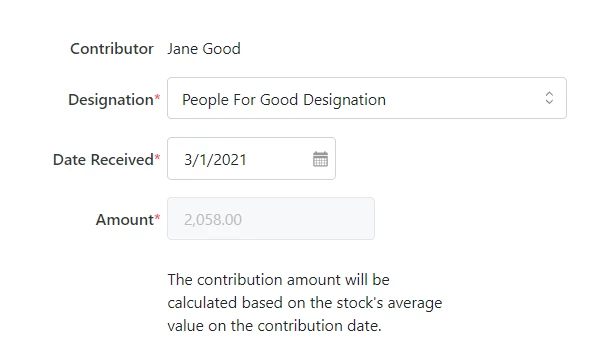

- In the Accounting section, select Stock as the Payment Method.

- Leave the Amount field blank.

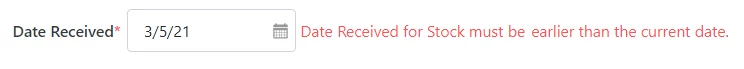

- Choose a Date Received that is prior to today and on a day the stock market was open.

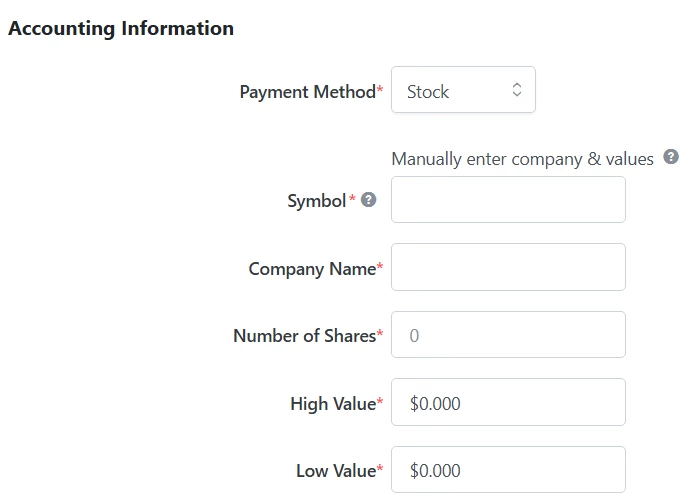

- Enter the Company Stock Name and Number of Stocks:

- Manually enter company names and values.

Tip: If the lookup tool does not return results, confirm that the Date Received is a market open date.

If you're entering a special contribution (e.g., tribute, grant, planned gift):

- Identify the gift type from the following list:

- Tribute Gifts

- Gift Memberships

- Planned Gifts

- Grants

- Peer-to-Peer Giving

- Household Giving

- Major Gifts

- Navigate to the appropriate section or tool in your platform specific to that contribution type.

- For example, Tribute Gifts may have a dedicated entry form.

NOTE: For gift types not listed or requiring specific accounting, contact Support to confirm the recommended entry method.

Step 3: Review or complete contribution details

For stock contributions:

- The system will populate the High Value and Low Value from the selected date.

- The Amount (greyed out) will be calculated automatically: (Number of Shares × Average Price on Date Received)

For special contributions:

-

Complete all additional fields required in the designated entry form for that gift type.

Step 4: Save and report

- Click Save to finalize the contribution.

- The contribution will now appear in your records.

For stock contributions:

Whenever you view this contribution in your reports, the calculated Amount will be listed, and the Payment Type will be Stock.

For special contributions:

Confirm the gift is reported correctly based on its type and entry method.