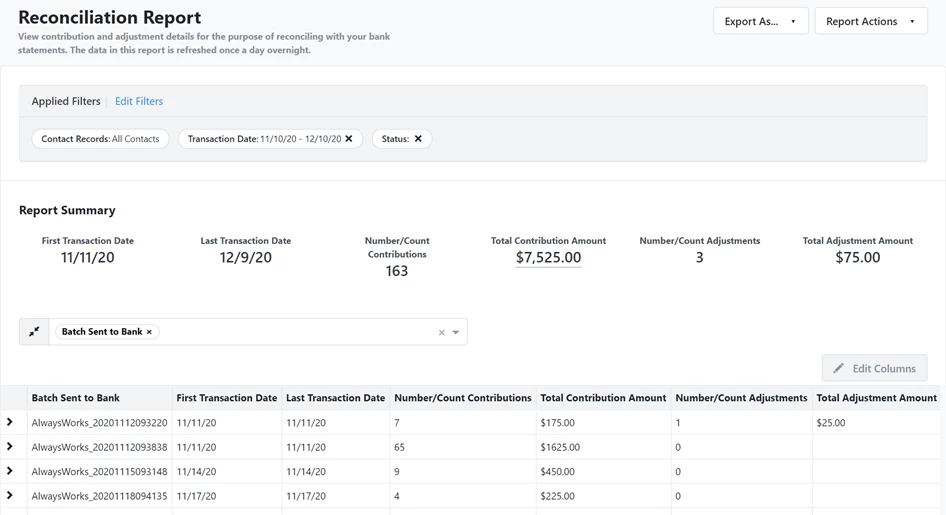

The Reconciliation Report allows you to see all contributions and adjustments in a single report and group them to match your regular bank statements. This report ensures that your database matches your bank statements so you can confidently complete your reconciliation processes and update your accounting system with the records in your database.

Read our Success Guide for accounting reconciliation

Understanding the report

This report works much like our other reports but it has a few default columns that consolidate data available in your other contribution or adjustment reports.

Status tracks which stage a contribution or adjustment is in during the transaction process.

-

if the entry is a Contribution, this will reflect the status available from any integrated payment vendors or edited manually by your staff; otherwise, it will default to Pending

-

if the entry is an Adjustment, this will reflect any status available from integrated payment vendors if applicable, otherwise it will be blank

Read more about tracking settlement status on contributions

The Transaction Date records the date associated with the transaction in your database.

-

if the entry is a Contribution, this will be the Date Received

-

if it’s an Adjustment, it will be the Adjustment Date Issued

The Date Sent to Bank represents the best approximation of when a transaction was sent to your bank account for funding. Transactions are likely to appear in your bank account within a couple of business days of this date, depending on the payment method and vendor.

For contributions, this is the same as:

-

Deposit Date for checks

-

Settlement Date for online payments

-

Blank if no Deposit Date or Settlement Date is available

On adjustments, this will show:

-

Adjustment Settlement Date on Settled Paragon, Stripe, and PayPal refunds

-

Adjustment Date Issued on manually recorded adjustments linked to Settled or Deposited contributions

-

Blank for Pending and Declined adjustments that have not been sent to the bank

The Batch Sent to Bank represents the batch in which a transaction was deposited into or debited from your bank account.

For contributions, this will show:

-

Deposit Number for checks

-

Settlement Batch for online payments with a batch available, such as Paragon credit card and PayPal contributions

-

Contribution Settlement Date for EFT/ACH and Stripe payments

-

Blank if no Deposit Number or Settlement Batch is available

For adjustments, the Batch Sent to Bank will show:

-

Adjustment Settlement Batch on Settled Paragon credit card and PayPal refunds

-

Adjustment Date Issued on manually recorded adjustments linked to Settled or Deposited contributions. This defaults to blank for Pending and Declined adjustments

Using the report to match your bank records

You can filter this report and add columns as you normally would, but the easiest way to make it match your bank transactions is to filter for the same time period as your bank statement and then Group by > Batch Sent to Bank.

While the Batch Sent to Bank may not match the final date of a deposit on your bank statement (since it often takes 1-2 business days after a transaction or batch is sent to the bank before it is fully funded), grouping it this way should make it easier to see the same daily net totals you see on your bank statement, factoring in both contributions and refunds. You can then adjust the dates by a day or two to match your exact bank statement.

Adding more information

You can add several optional columns that will help you track your transactions including:

-

Contribution Online Reference Number

-

Contribution Status

-

Contribution Settlement Batch

-

Contribution Settlement Date

-

Adjustment Online Reference Number

-

Adjustment Status

-

Adjustment Settlement Batch

-

Adjustment Settlement Date

Looking for training?

Explore this feature at your own pace - join a live training session or watch a recorded webinar by clicking the link below.