Attention: EveryAction Development is now Bonterra Development. Please bear with us as we update our screenshots to match our new name.

(3 min read)

When a donor contributes to your organization, it's common (and sometimes required by the IRS) for your acknowledgment to contain information regarding how much of the contribution may be tax-deductible.

If your donors are purchasing tickets to fundraising galas or you are providing high-end premiums as thank you gifts, there is a chance that your donors are receiving goods and services in exchange for their donation. When this is the case, you can track the fair market value of the goods/services they receive and let your donor know how much of their donation may be tax-deductible.

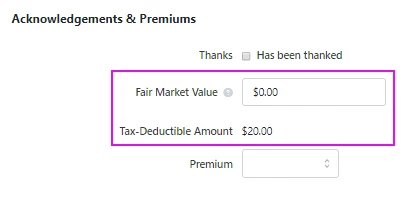

In order to use this feature, you must have tax-deductible tracking enabled for any of your designations that receive charitable donations. Contact Client Services if you need to enable this (or are unsure if it is enabled). Once it has been enabled, two values will appear on all contributions: Fair Market Value and Tax-Deductible amount. Once you enter the Fair Market Value, our system will automatically calculate the tax-deductible amount.

Adding Fair Market Value to Contributions

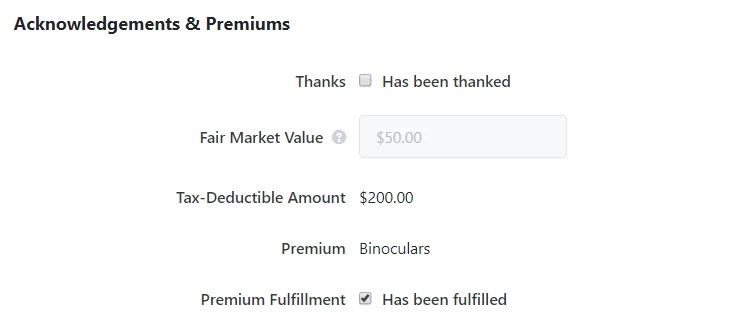

When you are adding a Contribution, you can adjust the Fair Market Value from the Acknowledgements & Premiums section. For most monetary contributions, this amount will be $0. The Tax-Deductible Amount is automatically calculated by subtracting the Fair Market Value from the contribution amount.

You can also add the Fair Market Value to several records at once using Report Actions >Bulk Edit from the Contributions Report or when you are adding or updating records using Bulk Upload.

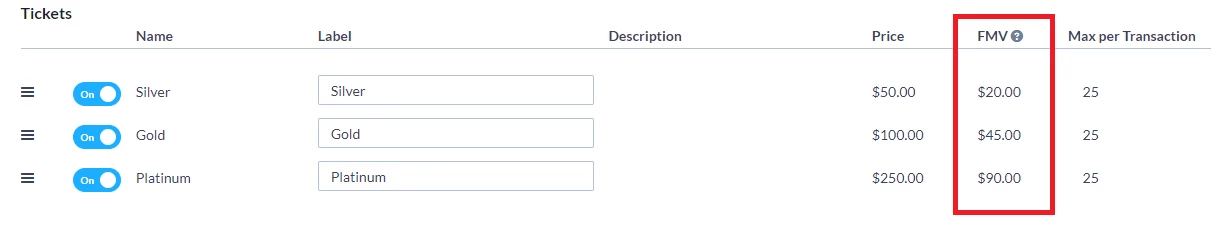

Adding Fair Market Value to Ticketed Events

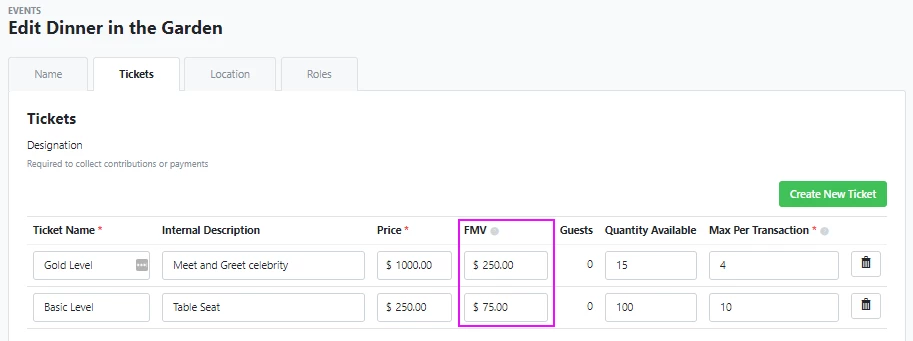

When you create a Ticketed Event, you can set the Fair Market Value (FMV) for each ticket level. Once this is set, the FMV will be added automatically on contributions from ticket purchases.

The FMV values will automatically display next to the ticket prices when you create a Ticketed Event Form.

When someone purchases tickets to your event, the donation is recorded as a single contribution that includes the total amount from all the tickets they purchased plus any additional contribution given at that time. The tax-deductible amount is then calculated by subtracting the FMV for each ticket.

For example, if a donor purchases 5 tickets that are $100 each and then decided to give an additional amount of $100, their Contribution Amount would be $600. If each ticket has an FMV of $20, $100 (5 x $20) will be subtracted from that total to calculate their Tax-Deductible Amount of $500.

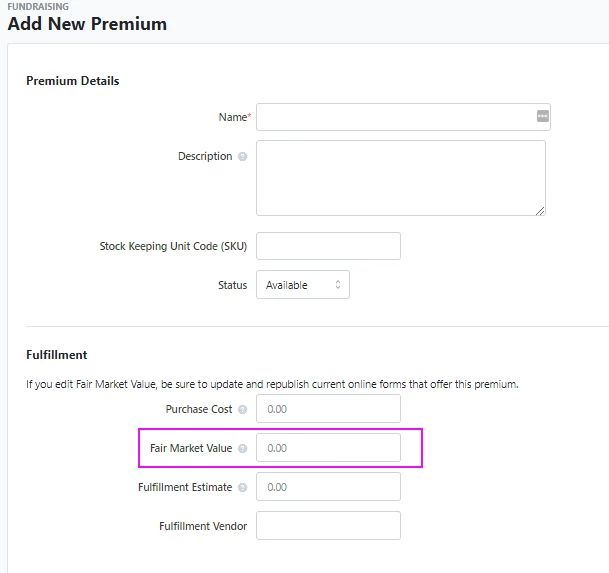

Adding Fair Market Value to Premiums

When you add a new Premium, you can add the Fair Market Value (FMV) of the item.

Once the Premium has been added to a contribution record, the FMV you assigned will be added and the Tax-Deductible Amount will automatically be calculated.

Read more about adding premiums to your Contribution forms

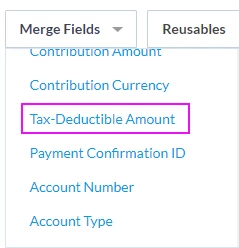

Acknowledging Tax-Deductible Amounts

When you create a Contribution Form in Online Action, you can use a merge field to add the Tax-Deductible Amount of their contribution to the Thank You page and the confirmation email.

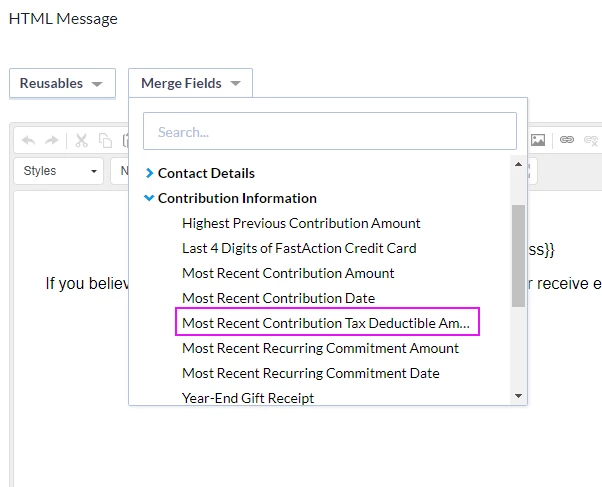

Your Targeted Emails can also include the Most Recent Contribution Tax-Deductible Amount as a merge field.

The Year-End Gift Receipts merge field will also include the tax-deductible portion of each donor contribution.

Read more about Year-End Gift Receipts

| Pro tip: If you need to send year-end reports to your donors that list their total Tax-Deductible amount, you can Create a List of records and then Export their information using the Contribution Aggregates Report. You will see a column in this report for the Total Tax-Deductible Amount Previous Year. You can use this export to create a mail merge file for your year-end communications to your donor. |

Viewing Tax-Deductible Amounts on other reports

You can see or add Fair Market Value or Tax-Deductible Amount to several reports, including:

- Attributor Report

- Contribution Report

- Contribution Acknowledgement Report

- General Ledger Contributions Report

- General Ledger Adjustments Report

- Premium Fulfillment report

- Ticketed Event Contribution Report

- Tribute Gifts Report

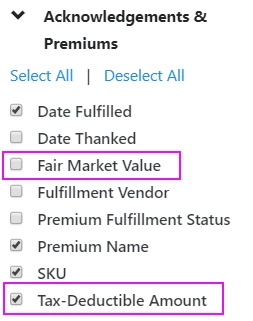

You can add these fields to those reports using Edit Columns > Acknowledgements & Premiums.