(4 min read)

Note: This article contains screenshots reflecting the Contact Record contact view. To toggle between the Contact Record view and the All Details view, select “View contact record” or “View all details” at the bottom left corner of your screen.

Planned Giving allows you to manage the entire gift planning process from start to finish, including:

-

Marketing planned giving opportunities

-

Tracking information requests from supporters

-

Managing every stage of cultivation

-

Building a history (and details) of communications to the supporter

You can assign future tasks to yourself or other Planned Giving officers for follow-up and stay up-to-date on all the details that need to be tracked and managed once a planned gift has been established.

Read more about finding prospects and reporting on Planned Gifts

Types of Planned Gifts

You can add multiple Planned Gifts to a contact record, including more than one of the same Type. When you create a Planned Giving Plan, the Type of gift will appear on a Contact Record under Ask Type.

There are four Types of Planned Gifts you can manage in EveryAction:

-

Bequests are direct contributions to your organization and are the most common type of Planned Gift. These contributions can come from:

-

Wills

-

Bequeathed assets

-

Retirement fund remainders

-

Life insurance

-

Track multiple bequests together or separately depending on your reporting needs.

- Trusts are assets that are managed as part of an external trust, rather than being given directly to your organization. You can select the Type of trust you are tracking and which Category it belongs to.

There are four Trust Types:

- Unitrust

- Annuity Trust

- Remainder Trust

- Charitable Lead Trust

There are five Trust Categories:

- Unitrust

- Regular Trust

- Net Income Trust

- Net Income Trust with Make-Up

- Charitable Remainder Trust

-

Charitable Gift Annuities are gifts made to your organization in return for fixed income payments over time with a tax deduction granted at the time of the gift. Usually, your organization then receives the remaining value of the asset upon the death of the donor.

-

A Pooled Income Fund is a trust that is established and maintained by a public charity. The pooled income fund receives contributions from individual donors that are commingled for investment purposes within the fund.

Getting started

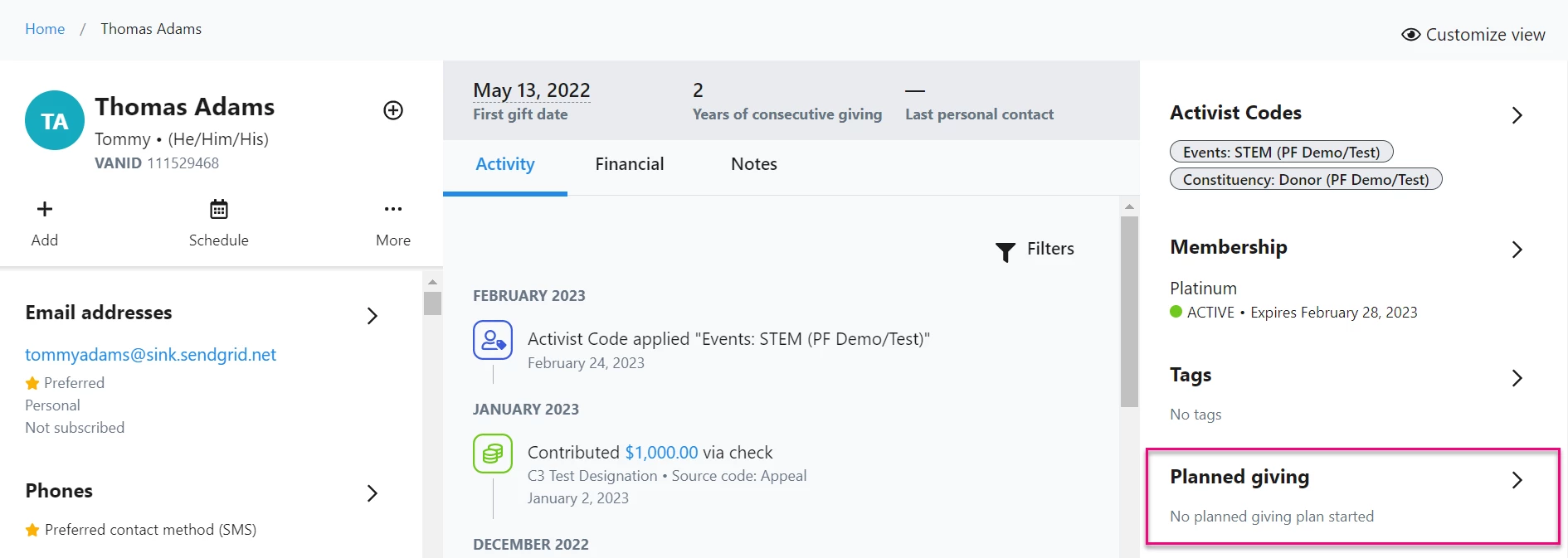

If you have access to planned gifts, you will see a Planned Giving section on the right column of the contact record page.

Open the drawer to view options for adding Planned Giving information.

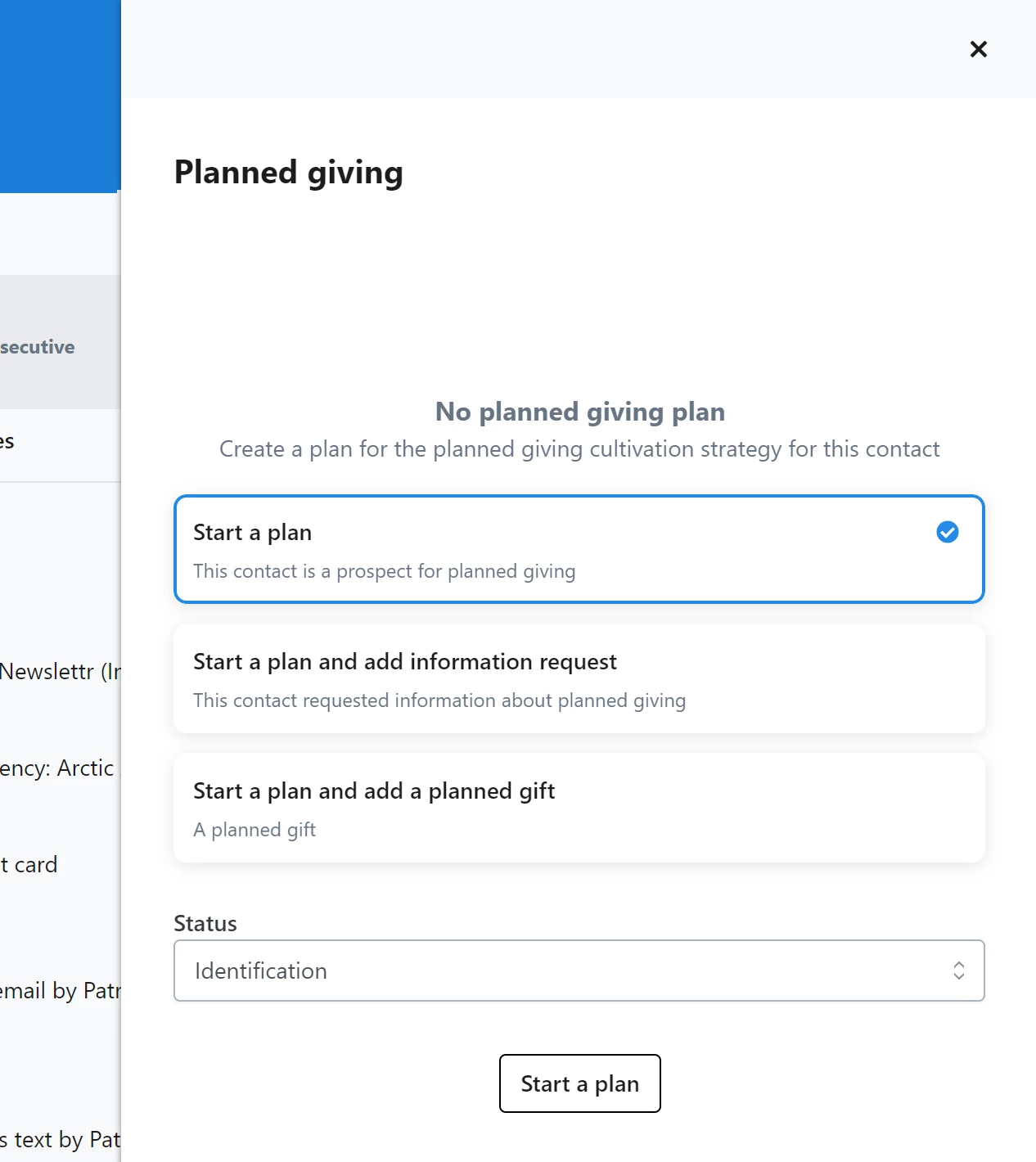

If your donor is a prospect for a planned gift, you can use Start a Plan to create a new Action Plan to manage your prospecting and cultivation strategy. This will create a Planned Gift Plan with a status of Identification, unless you select an alternative option. You can then continue to add to this plan through each step, such as cultivation, solicitation, and so on.

If instead you are contacted by a potential donor requesting more information, you can select Start a Plan and Add Information Request. This will create a plan and set the status to Identification, unless you select an alternative option. You can then continue to add information as your plan progresses.

Read more about adding an Information Request

You can then use the Fundraising Optimization Guide to help you track how well you are converting donors who request planned giving information.

Read more about the Fundraising Optimization Guide

If you have received a new gift from a donor, you can also Start a Plan and Add a Planned Gift to enter gift information directly. Once the gift is saved, use the contact record breadcrumb to navigate back to the contact and view a summary of the newly created Planned Giving Plan.

Adding details

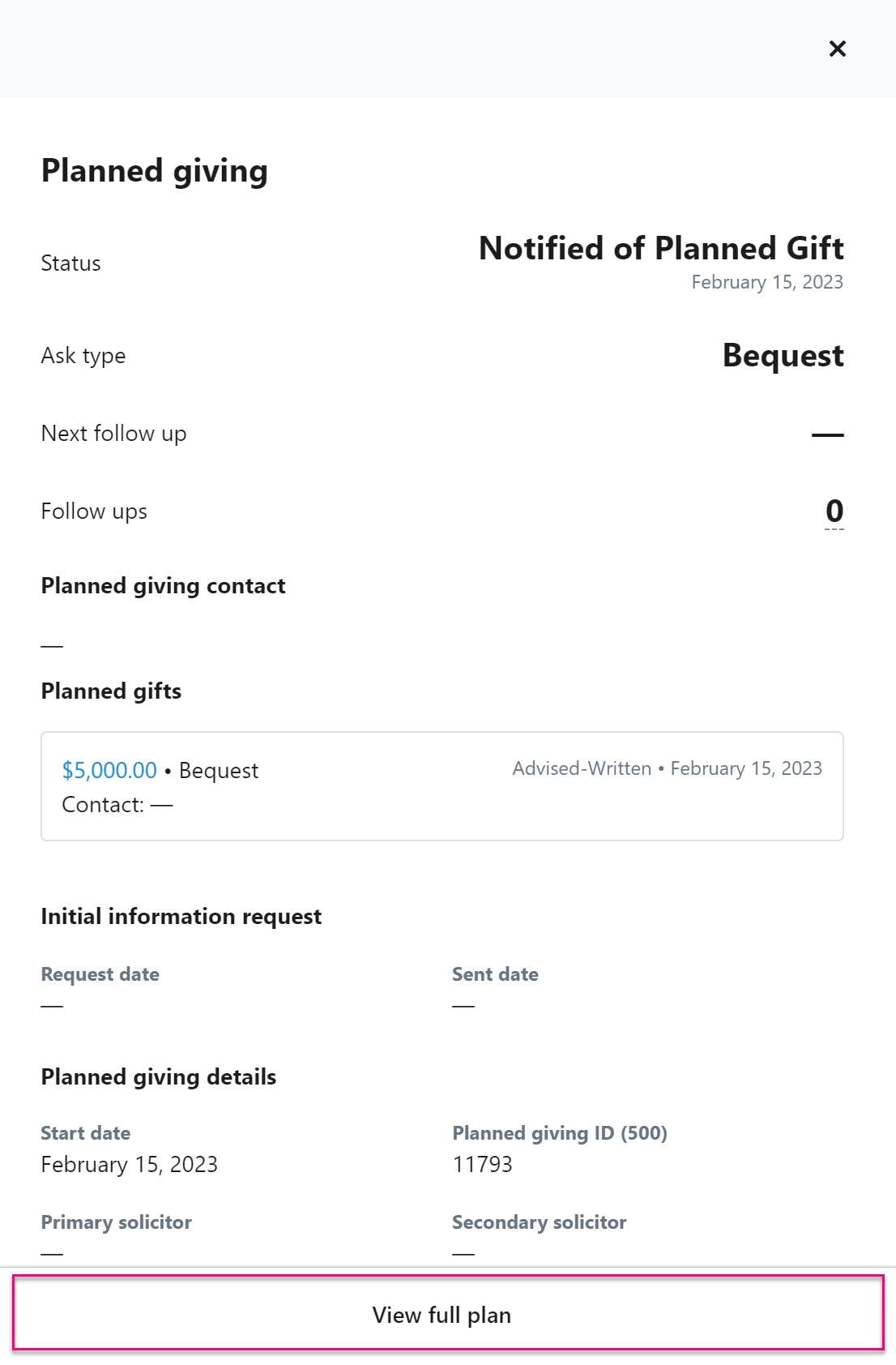

After you've created a Planned Giving Plan, select View full plan at the bottom of the drawer to update details and add things like notes and file attachments to help you track this gift's progress.

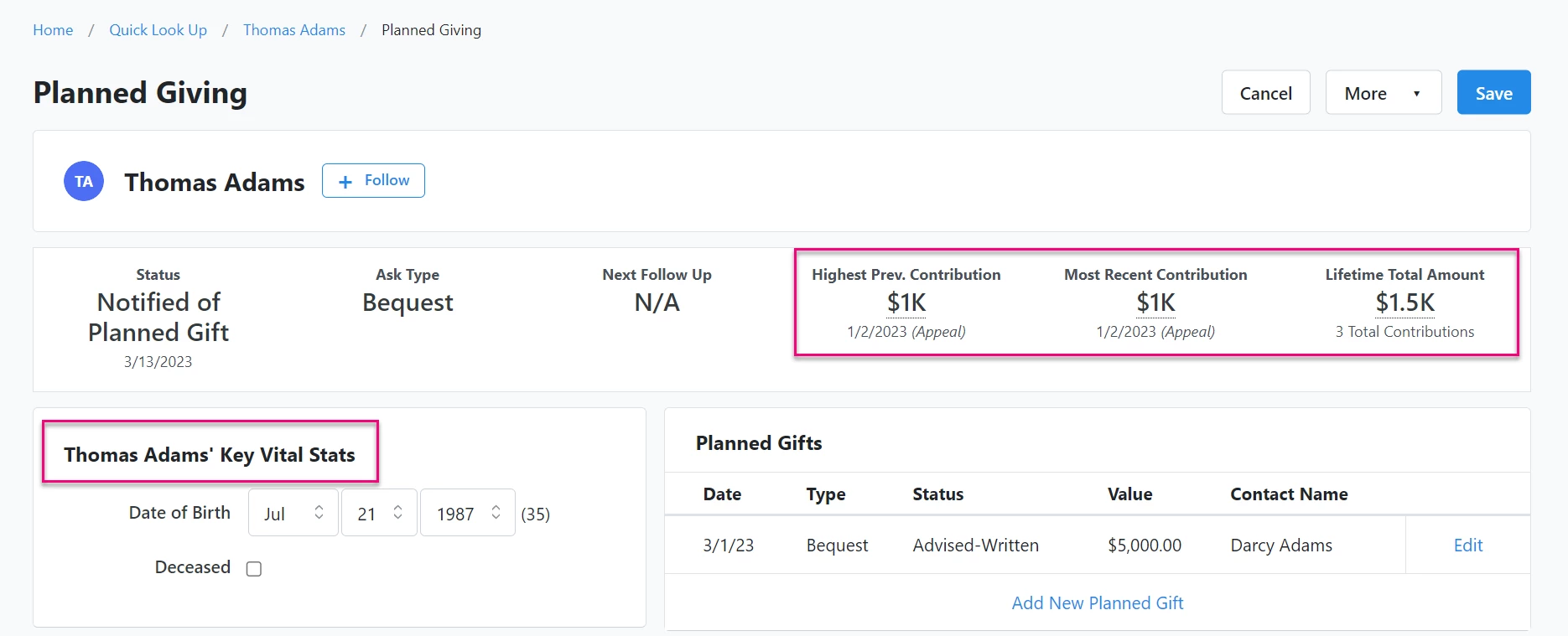

You will also see a few more details from the contact record automatically displayed in Planned Giving, including Key Vital Stats (DOB and deceased information), Highest Previous Contribution, Most Recent Contribution, and Lifetime Total Amount.

If you use WealthEngine and have an API key for your account, you will be able to view that information on the record as well.

Managing follow ups

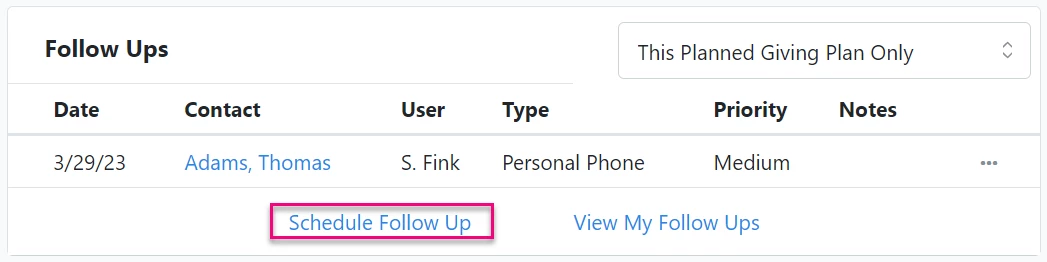

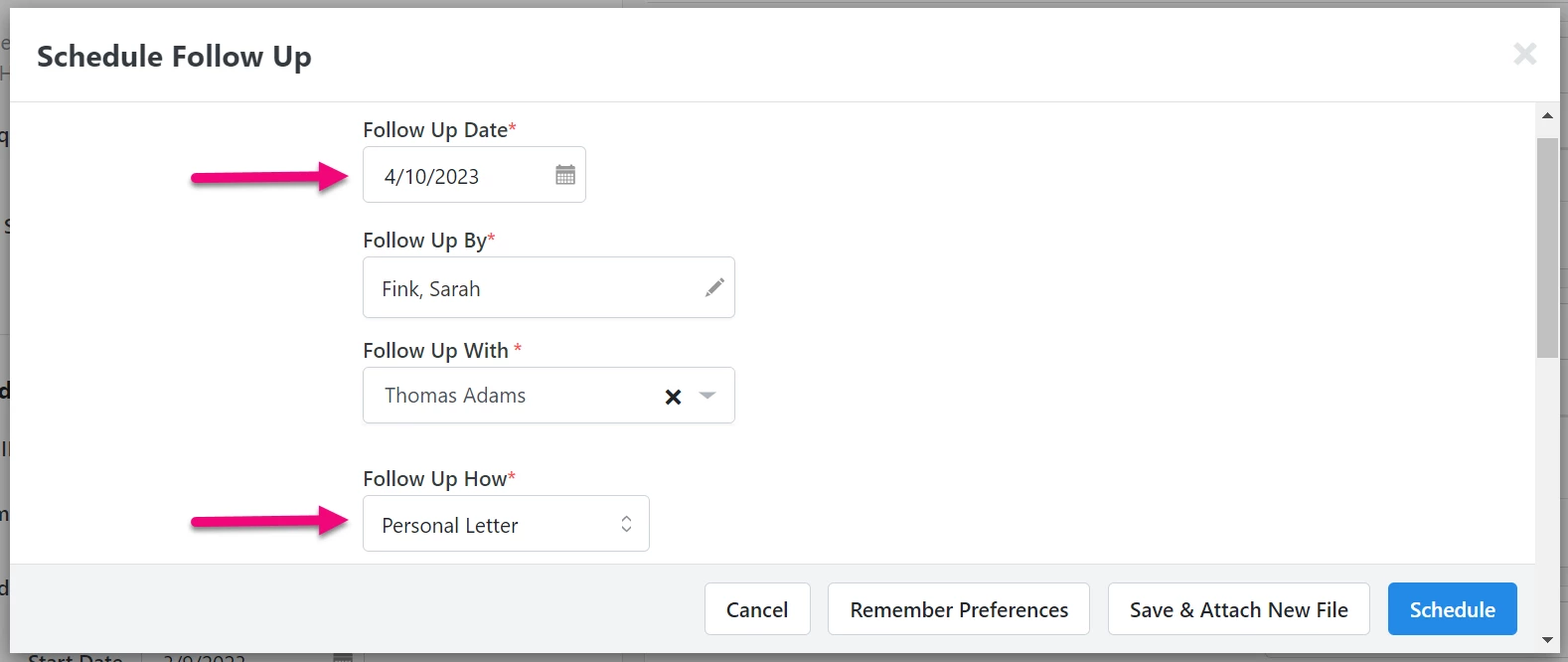

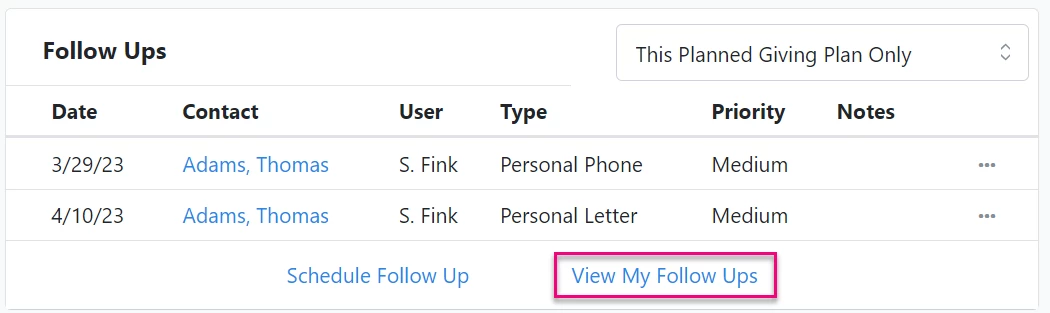

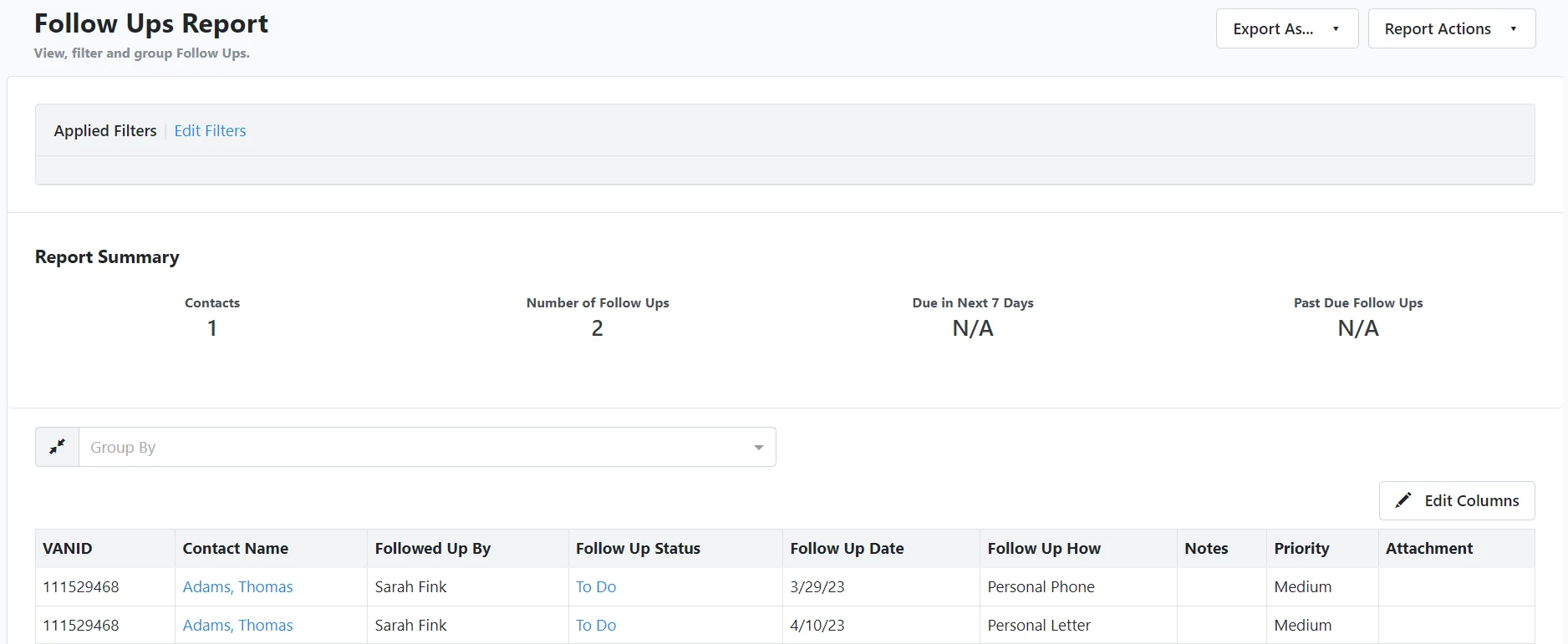

Follow Ups help you manage outreach efforts and determine which tasks need to happen next. With Schedule Follow Up, you can select a follow-up date and the details for the next step for a contact.

You can also quickly view all of your upcoming follow-ups by clicking on View My Follow Ups.

You can also run a Follow Ups Report from Report Manager.

Managing key relationships

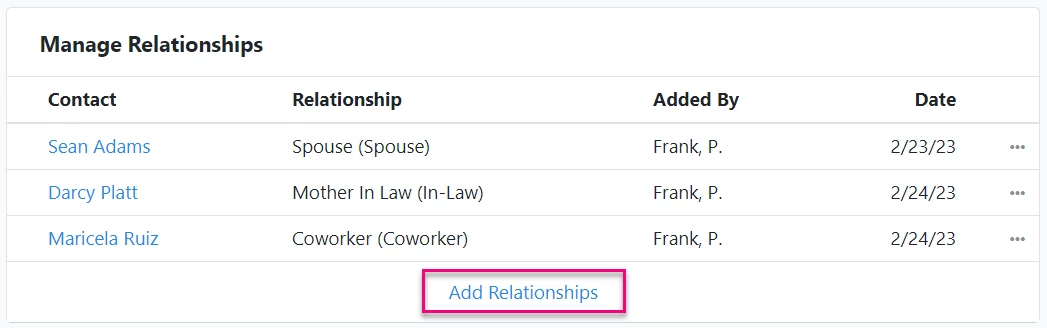

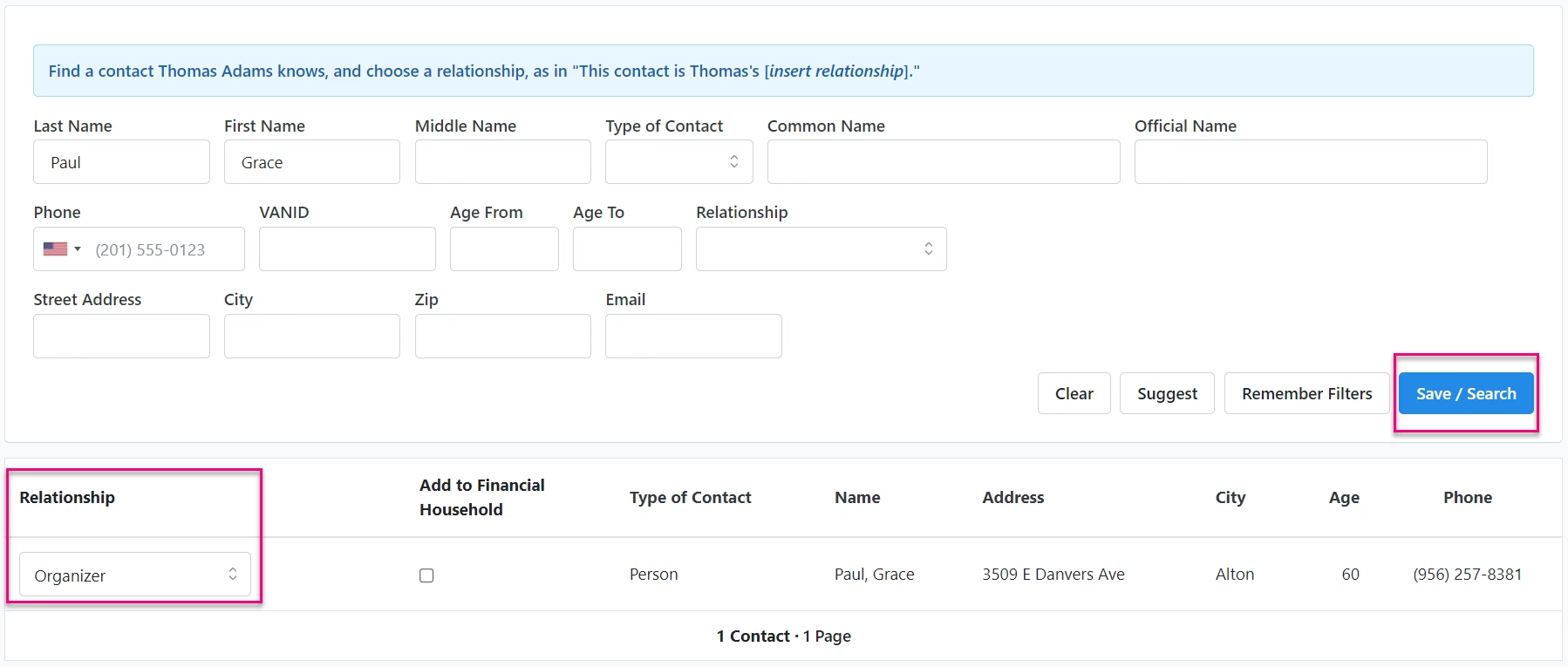

In certain circumstances, your main point of contact for a Planned Gift may be an external advisor such as a financial planner, estate attorney, or tax professional. You can use the Manage Relationships section to link those contacts to your donor, and later link them directly to a Planned Giving Plan.

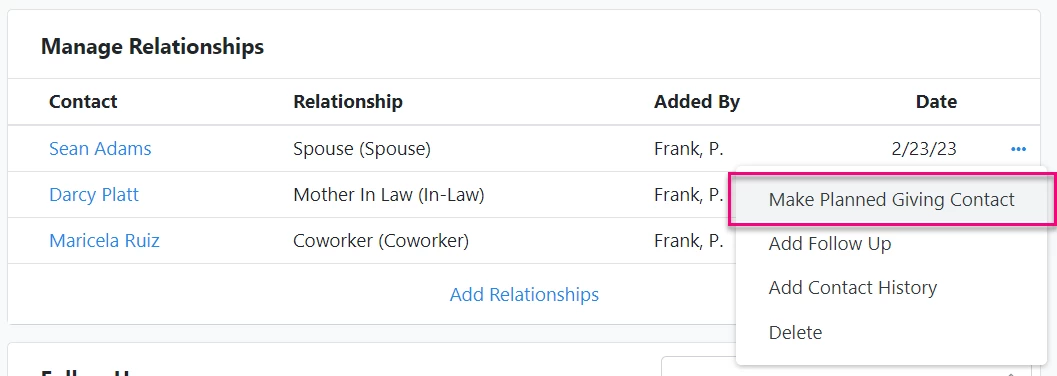

Search for the relevant contact record, select the type of Relationship, and click Save/Search. Then click back to the contact record.

Once a Relationship has been added, select Make Planned Giving Contact from the action dropdown (...) to the right of your contact's name.

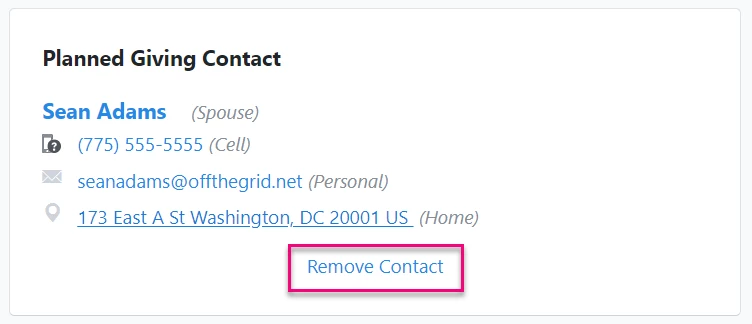

There can only be one Planned Giving Contact at a time. In order to change the contact, you must first remove the current one by clicking on Remove Contact. Only then will the Make Planned Giving Contact option appear on other relationships.

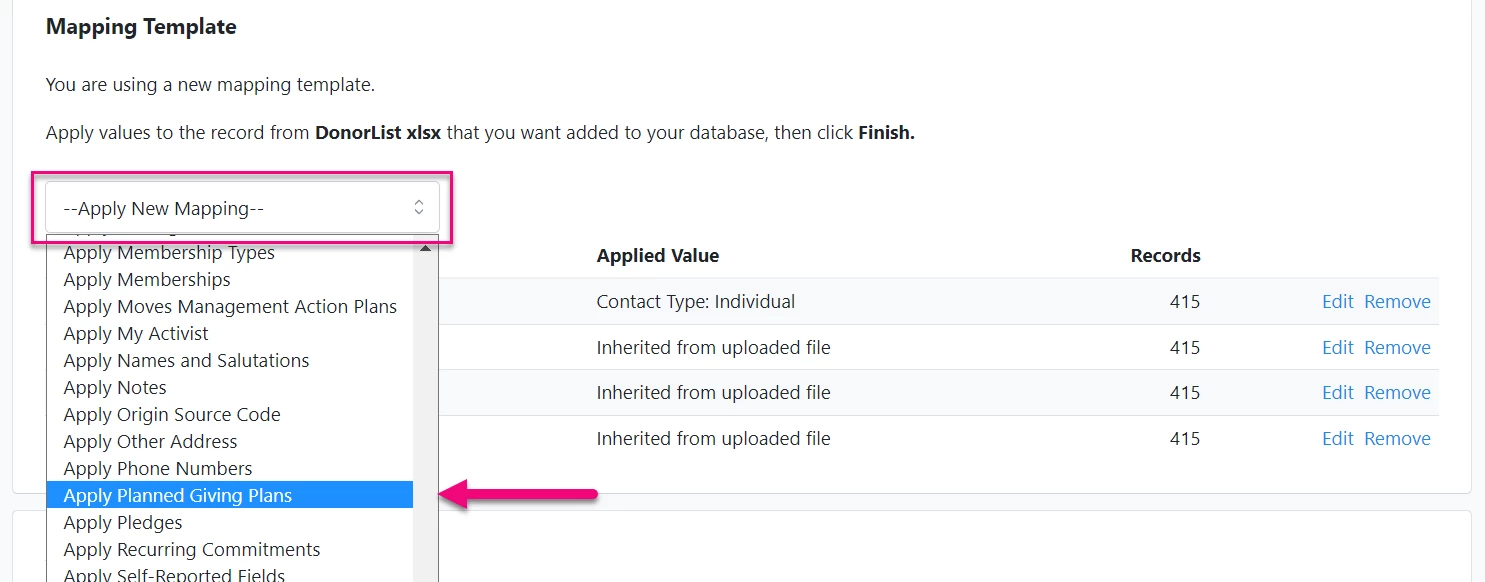

Bulk Applying planned giving information

You can import planned giving information to your contact records or update several planned gifts at once using Bulk Apply. Use Apply Planned Giving Plans as the mapping option to add your Planned Giving details.